Title

- Author: Emilio Cazares (SuperRare Labs Legal Innovation Counsel), John Crain (SuperRare Labs CEO), Thomas Wu (SuperRare Labs Director of Finance), Jonathan Perkins (SuperRare Labs CPO), Sushen Talwar (SuperRare Labs Controller); Kyle Olney (SuperRare Labs Director of Product)

- Status: Implemented

- Type: **Treasury, Ecosystem Growth **

- Implementer: SuperRare Labs | RareDAO Foundation

- Sponsor(s): Pindar Van Arman; Serena Tabacchi

- Link to Temperature Check Poll: Discord

- Created Date: 06/05/22

Summary

A Proposal to formalize a community-approved contractual relationship between SuperRare Labs Inc. (the “Company”) and the RareDAO Foundation, the independent non-profit Foundation established for the benefit of the SuperRare DAO (”DAO” or ”RareDAO” or “SuperRare DAO”). This Proposal also embodies terms and procedures by which the SuperRare DAO may formalize other contractual relationships with third parties and aims to act as an example by which other third parties may seek funding from the DAO to perform ecosystem-benefitting activities.

Motivation

The SuperRare DAO is in need of competitive development from sophisticated parties ready and willing to add value to its ecosystem and contribute further to its decentralization. Since the launch of the SuperRare DAO, and as a testament to the Company’s commitment to the community, 100% of all commissions and fees on SuperRare have been routed to the community-controlled DAO treasury (previously sent to the Company before the launch of the DAO). The Company now seeks the community’s approval in formalizing its relationship and establishing a funding mechanism so that it can secure the ability to continue developing SuperRare. Although the Company is likely in the best position to act as the primary contributor to the ecosystem due to its existing expertise, operations, staffing, and resources - it acknowledges that decentralization necessitates the ability of third parties to seek community approval to accessing funding for ecosystem-benefitting activities (See also SIP |“Can the Devs Something (RARE)?”). Accordingly, the Company desires transparency in establishing a contract to serve the DAO and wishes to act as an example for future developers, promoters, curators, content creators, engineers, etc. who wish to establish services contracts with the DAO.

Specification

This specification sets forth some of the most material terms that the Company stands ready to perform on with the approval of the community. The Specification is not intended to act as a contract or offer capable of acceptance by the DAO, but rather a guide by which a future agreement may be entered into by the Company and the RareDAO substantially reflecting the material terms contained in the proposal ultimately voted upon.

Parties

(1) The Company, a Delaware corporation that originally conceived of and created SuperRare, and (2) the RareDAO Foundation, a Cayman Island non-profit foundation established for the benefit of the SuperRare DAO.

Services

It is the wish of the Company to continue providing research & development, engineering, infrastructure, promotion, business development, marketing, staffing, curation, and the provision of technology and other services necessary to successfully support, promote, market, curate, maintain, improve, decentralize, govern and grow the DAO as generally described and set forth at docs.superrare.com. The Company will perform the following non-limiting types of Services:

- Protocol Development

- Product Development and Engineering Services

- Marketing and Promotional Services

- Curation Services

- Editorializing, Content Creation, and Media

- IT Services

- Business Development

- DAO Administration, Strategy, and Management

- General Administrative Services

- General Operational Services

In order to ensure that the Company has the flexibility and certainty in performing authorized activities on behalf of the DAO, the above Services should not be limiting. The Company should be authorized, in advance, to perform any Services that it deems, in its discretion, to be in the best interest of or to otherwise benefit SuperRare, users, and the DAO but only to the extent that such Services are not expressly prohibited by the DAO Community.

Financial Details

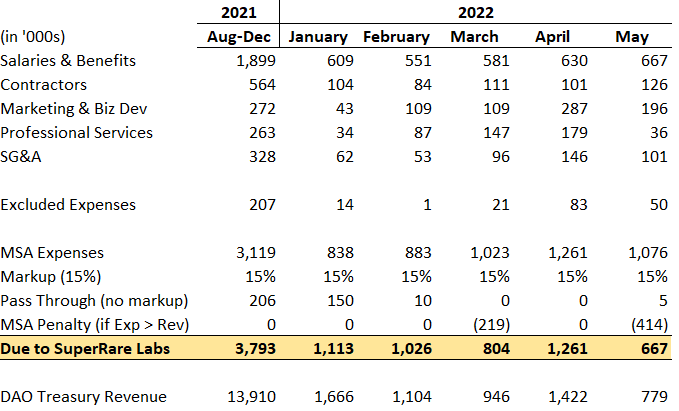

Since the formation of the SuperRare DAO, all commissions and fees have been directed into the DAO Treasury and the Company has been self-funding the operational expenses necessary to continue ongoing operations of the DAO. The operational expenses that have currently accrued and are due to the Company between Aug 17th, 2021 (the “Launch”) and May 31st, 2022 total around $8,664,347.11 (”Past Expenses”). During this time, the DAO Treasury has earned over USD $19.8 million equivalent in ETH (calculated based on the time of the transactions). These financial details also demonstrate the explicitly excluded expenses, which shall not be reimbursed, and the operation of the limitation on payment term (described further below in Limitations of Payment section) when the amount due to the Company exceeds the marketplace revenue. For example, in a given month the DAO only earned $500K in commission and fees, and the Company’s expenses exceed $500K, the Company is only entitled to receive 85% of the fees earned by the DAO ($500K x 85% = $425K).

Payment

The Company seeks to recover on a monthly basis any and all operational, general, and administrative costs actually incurred in performing Services that benefit the DAO, plus an arms length transaction markup of fifteen percent (15%), but only to the extent that such Services do not exclusively benefit the Company. The Company seeks to recover all pass-through expenses incurred on behalf of the DAO (without markup) since the Launch that relate to the types of Services contemplated by the parties, also only to the extent that such expenses do not exclusively benefit the Company. At this time, the Company does not seek to immediately recover in full the lump sum of the accrued Past Expenses but does not waive any right or entitlement to such Past Expenses. The Company may seek future installment payments for the Past Expenses without interest.

Limitations on Payment

In an effort to align incentives between the Company and the DAO Community, and to further ensure that the Company is always incentivized to act in the best interest of the DAO, the Company proposes a limitation on its ability to receive payment based on the performance of the SuperRare marketplace. If payment due to the Company as provided above at the end of a given month, excluding the markup, exceeds the USD equivalent of the total DAO revenue received from marketplace activity (or due to the Company’s services) then the Company shall only be entitled to receive eighty-five percent (85%) of the USD equivalent of the total DAO revenue for that month (and any pass-through expenses not subject to markup). The Company is only entitled to the fifteen percent (15%) markup to the extent that it does not exceed the USD equivalent of the total DAO revenue for any given month.

Payment Procedure

The Company shall submit an invoice to the RareDAO Foundation after the end of each calendar month accounting for its total qualifying operational, general, and administrative costs and expenses in USD. At the option of the Company, the invoice shall seek payment as due in Ether (ETH), $RARE, or any other ERC-20 asset or combination of assets within the DAO Treasury, provided that the Company shall not receive an amount of $RARE exceeding 50% of each invoice if there is ETH or stablecoins available to draw from. Conversion for any ERC-20 token to USD calculation sought as payment under any applicable invoice will be performed at the time of invoice issuance, which will be no later than 5 business days after the end of each month. Upon receipt of the invoice, the independent RareDAO Foundation Director shall provide a written approval of the invoice and authorize the Council to release the invoiced amount from the Council multi-sig to a publicly disclosed Company wallet.

Term

Limited to a one (1) year term, with automatic renewal for subsequent one-year periods, unless either party notifies the other in writing of its intent not to renew at least thirty (30) days prior to the end of the then-current term. The DAO Community is empowered to terminate or modify the agreement at any point during the term in accordance with the then current governance procedures.

Retroactive Approval of Services

The passage of this proposal should also serve to retroactively authorize the Company’s activities and services performed since the Launch of the SuperRare DAO and compensate the Company retroactively according to the payment procedures provided in this Proposal, as if such past Services were rendered during the Term of the Services Contract.

Intellectual Property

The Company intends on contributing all Protocol related code (i.e., smart contracts) that it owns and that is created under the term of the Agreement to the RareDAO Foundation, subject to the DAO’s adoption of relevant open source and intellectual property policies that should be approved by the Community at a later date. To the extent that any intellectual property developed by the Company during the term of the Agreement is not subject to assignment obligations to the RareDAO Foundation, the Company intends on granting the RareDAO Foundation a license to such intellectual property.

Transparency

In an effort towards establishing transparent precedent for DAO-approved contracts, the Company will consent to making the following available to $RARE token holders who submit a request in writing to [email protected] and comply with any requested KYC or procedural measures:

- The executed Services Contract;

- A templatized version of the Services Contract; and

- All invoices submitted to the RareDAO Foundation

Additionally, the Company will publicly disclose the wallet to which payment under the agreement will be sent and all payment transactions performed under the agreement

Non-Exclusivity

The Company is not given any exclusive right to provide Services for the benefit of the DAO. The RareDAO Foundation shall have the unlimited right to engage or seek engagement with additional services providers, vendors, or other third parties to provide services for the benefit of the DAO or for any other reason. Indeed, as part of the Company’s services it will actively seek to create opportunities for third party service providers to add value to the SuperRare DAO.

Amendments

Amendments to the agreement shall not require DAO approval only to the extent that such modifications are approved in writing by the independent Foundation Director and by a majority of the DAO Council as of the date of the proposed modification. By majority decision, the DAO Council may elect to require subsequent modifications to be approved by, ratified, or otherwise supported by the DAO in accordance with the necessary DAO governance procedures. All final, subsequent amendments to the agreement shall be publicly noticed.

The Final Agreement

The final written agreement between the RareDAO Foundation will be significantly more detailed and will contain other standard terms not mentioned in this Proposal. The passage of this Proposal will authorize the Council, by majority agreement, to enter into any services contract with the Company that does not depart from the the material terms contained in the final community-approved Proposal and to otherwise approve subsequent transactions or requests by majority Council agreement related to this Proposal, whether or not provided or contemplated herein. The Community will always have the power to inspect and, if necessary, demand a modification of the final agreement through the then-current SuperRare Improvement Proposal governance procedures.

Benefits

The SuperRare DAO will secure the labor and resources of a sophisticated and experienced network contributor, which will help SuperRare network continue to develop, decentralize, and maintain its edge in an increasingly competitive industry. The DAO will also participate in a transparent, full lifecycle contract negotiation process that will serve as useful precedent and encouragement for other service providers who want to add value to the SuperRare ecosystem.

Drawbacks

The DAO Treasury will bear the costs when it enters into a services contract for the Company’s labor and services.

Outcomes

Due to the monthly accounting process and limitations on the Company’s ability to spend in excess of the monthly DAO revenue, it will be relatively easy to monitor payment to the Company and to otherwise determine whether the Company is performing by inspecting the DAO revenue, general marketplace activity, curation, growth, etc. The Company and the DAO Council should both independently provide a statement before the contract renewal period explaining the basis for its intent to renew or not renew in order to enable the DAO Community to decide whether it wants to prevent renewal.

CONFLICTS DISCLAIMER: THIS PROPOSAL IS DRAFTED BY SUPERRARE LABS PERSONNEL WHO HAVE A DIRECT AND MATERIAL ECONOMIC INTEREST IN THE PROPOSAL’S SUCCESSFUL PASSAGE.