Intro

Based on some preliminary research and discussion with individuals involved with the DAO, it has come to my attention that SuperRare’s treasury is quite strongly denominated in idle $RARE tokens - these could be used more productively to generate revenue for the treasury and subsequently used to diversify and fund new initiatives. I would like to present this brief RFC memo to guage interest prior to making a full proposal that would help to achieve this objective through employing on-chain covered call strategies.

Idea

The idea is to leverage a portion of SuperRare’s treasury through on-chain covered call lending. This approach involves lending out a smaller part of currently idle $RARE tokens. By doing so, SuperRare can generate significant upfront revenue in USDC. The earned USDC can be immediately utilized for community needs. And unlike a simple token sale, covered call lending enables the treasury to diversify its holdings into stable assets without an immediate market impact.

Benefits

• Idle $RARE tokens can be used to generate upfront USDC revenue

• Immediate revenue and liquidity for operational and developmental activities

• Diversification of the treasury into stables

• Tokens don’t need to be sold, thus there’s no immediate market impact

Example Scenario

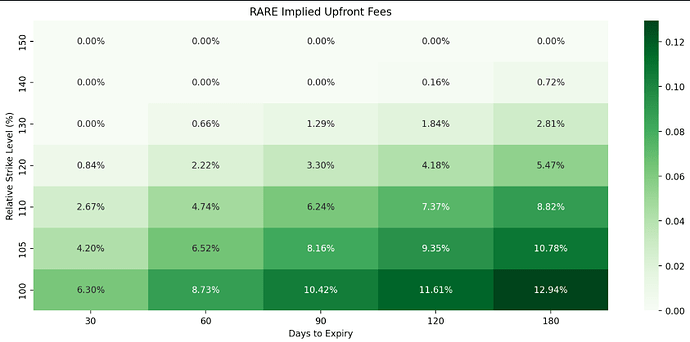

The diagram below shows indicative upfront premiums (as of Jan. 17, 2024) that the SuperRare treasury could earn across various loan duration (Days to Expiry) and upside cap (Relative Strike Level) combinations

For instance, SuperRare treasury lends $100k worth of $RARE for 90 days at a 110% upside cap. In turn, SuperRare treasury gets approx. $6.25k USDC upfront.

If the $RARE price remains below 110% after 90 days, the originally loaned $RARE is returned. If it exceeds 110%, SuperRare treasury receives $110k USDC (and still keeps the initial $6.25k USDC upfront as well).

Conclusion

This proposal outlines how the SuperRare community can generate USDC stablecoin revenue by using idle $RARE treasury for covered call lending. This approach not only diversifies the treasury but also avoids market impacts that could arise from outright selling $RARE tokens.

Would love to hear feedback and comments from the DAO and community and would be happy to make put together a full proposal outlining each of the above points in detail and describing additional benefits.