Authur: BΞN & FRΞNS

Status: Temperature Check

Type: Governance

Sponsor: TBD

Implementor: SuperRare

Created Date: June 28, 2022

Summary

We propose a new incentive for Reserve auctions to drive increased bidding activity and higher market volume on SuperRare.

In the proposed setup, a bidder who hits a reserve and is subsequently outbid receives 5% of the final sale price.

Abstract

Additional details are described under Specification

Motivation

Reserve auctions can drive higher sales for artists and higher volume for SuperRare than list prices due to no price ceiling and the opportunity for bid wars. However, they are also less attractive for Collectors than list prices due to the risk of being outbid. As a result, many Reserves are not met and lay dormant.

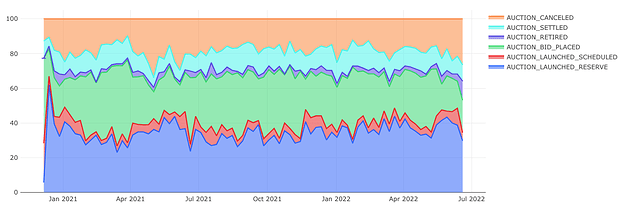

We can see in this chart that only 10% of interactions with the SuperRare auction contract are settlements, indicating that many reserves are canceled or never met.

The proposed setup makes it a win-win for a bidder to hit a reserve: they either win the piece or get outbid and collect a portion of the sale. We expect that this strategy will drive more bids and faster bids, thus catalyzing market activity on SuperRare. Lowering risk and increasing the upside for bidders will mean that pieces sell faster.

The expected second-order effect is that this incentive structure will motivate more artists to set reserves in lieu of list prices. The expected result is an increase in total market volume, due to reserve prices being more conducive to open price discovery and bid wars.

Specification

We propose that a collector who hits a reserve and is subsequently outbid receives a 5% cut of the final listed sale price. This still applies if the collector places the winning bid after being outbid any number of times.

The 5% could be sourced from either the:

- Seller’s cut, in ETH

- Marketplace cut, in ETH

- SuperRare DAO treasury, in $RARE

- SuperRare DAO treasury, in ETH

- Some combination of the above

There are pros and cons to each approach.

Distributing in $RARE is the simplest option, as it requires no contract-level changes. We propose introducing this approach for a trial period to test the waters. It could be implemented in the same way as collector royalties, with a monthly claim amount for eligible recipients. The downside of this approach is the risk of creating sell pressure for $RARE.

Sourcing from the Seller’s cut is another alternative. On SuperRare, to outbid an existing offer, one must bid at least 10% higher. As such, the final sale price is guaranteed to be at least 10% higher than the reserve, in the event that an original offer is outbid. So in the proposed setup, the seller always takes home more each time an offer is outbid, even if they pay a 5% cut. And if the original offer is not outbid, then there is no haircut outside the standard marketplace fees.

Note: this same incentive structure could be applied to Scheduled Auctions with a Starting Bid Price (reserve). However, to keep things simple, we propose piloting this with reserve auctions and then potentially expanding to Scheduled Auctions.

Benefits

- More reserves are met and met faster

- Higher sales volume on SuperRare: this is a result of the above and a greater utilization of reserves versus list prices

- Improved UX for collectors: they get rewarded for hitting reserves

Drawbacks

- Possible implementation work

- Risk of creating sell pressure, if the reward is distributed in $RARE

Outcomes

The following outcomes would suggest that this change has a positive impact:

- Reserves are hit more often

- Higher total market volume (this is impacted by many factors)

Thank you Keegan Ead for input on a draft and for sharing the chart